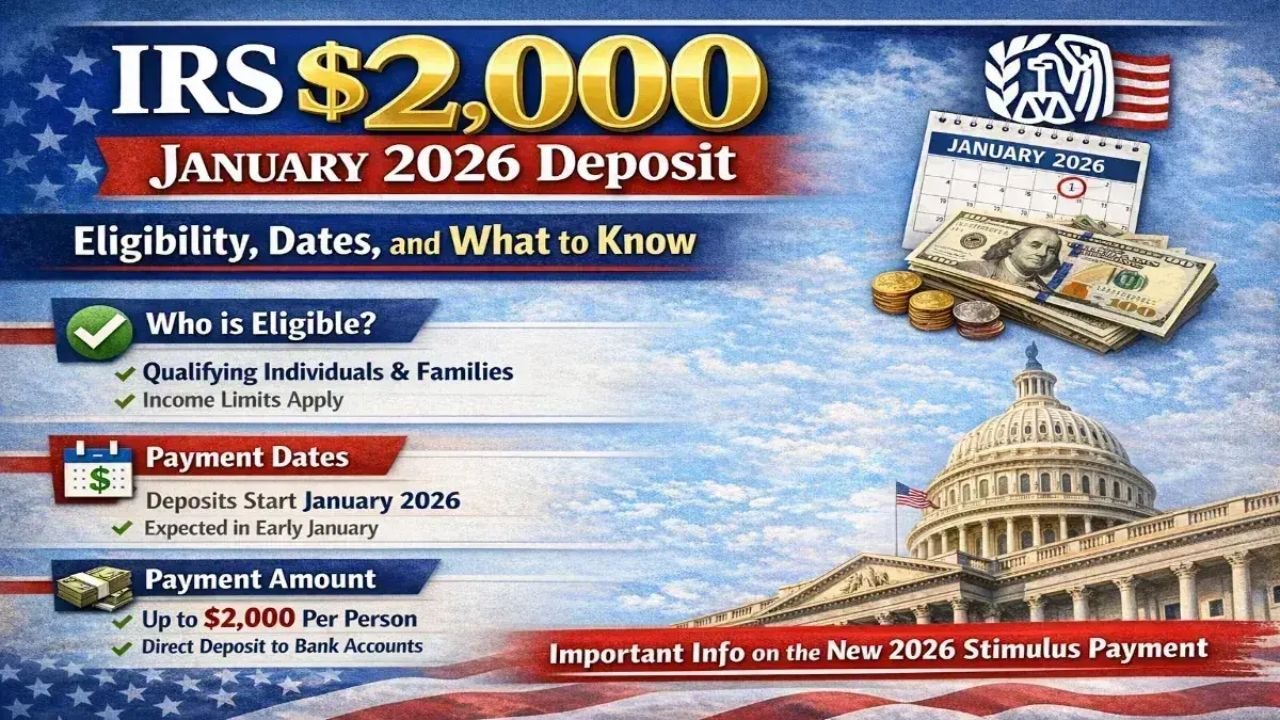

The topic of a possible $2,000 IRS deposit in January 2026 has generated widespread interest and speculation across the United States. Many taxpayers are eager for clarity on whether this payment is real, who may qualify, and how it will be delivered. Social media posts and online headlines often portray it as a new stimulus check, but the reality is closely tied to existing tax systems rather than a separate emergency program.

Understanding the facts can help taxpayers avoid confusion, prepare responsibly, and set realistic expectations.

What the IRS $2,000 January 2026 Deposit Actually Is

Contrary to some online claims, the $2,000 January 2026 deposit is not a universal stimulus payment. Instead, it refers to payments tied to refunds, refundable tax credits, and adjustments or corrections processed through the IRS during the early part of the tax season.

Taxpayers may see deposits approaching $2,000, but the amount varies widely based on income, filing status, dependents, and eligible credits. Each payment is calculated individually using IRS records and recent tax filings.

Why the $2,000 Figure Is Frequently Mentioned

The $2,000 number has gained attention because combined refunds and credits can reach this range for many taxpayers. Refundable credits, including those linked to income, children, or prior year adjustments, can significantly increase the total refund.

The timing of these deposits in January—when tax filings begin to be processed—also fuels speculation and online confusion. Deposits appearing in bank accounts may resemble stimulus payments, even though they are part of standard IRS procedures.

Who May Qualify for the Payment

Eligibility for a January 2026 IRS deposit is not automatic for everyone. It depends on several tax-related factors:

- Filing accurate and complete tax returns

- Qualifying for refundable credits based on income, dependents, or past adjustments

- Having current IRS records with correct banking information

Working families, low- to middle-income earners, and individuals claiming certain credits are more likely to see deposits close to $2,000, but amounts are determined on a case-by-case basis.

Expected Payment Timeline

IRS deposits are issued in phases throughout January, rather than on a single date. Taxpayers who file early and opt for direct deposit typically receive funds faster. Those who rely on paper checks should expect additional processing time.

Delays can occur if the IRS needs to verify information, correct errors, or resolve discrepancies in returns. Patience is often required during peak processing periods, especially for larger refunds or complex filings.

How Payments Are Delivered

Most payments are sent via direct deposit to the bank account on file from the most recent tax return. This method is faster, safer, and more reliable than paper checks, which are mailed and take longer to arrive.

Keeping banking and mailing information up to date is essential. Outdated or incorrect details can lead to delayed payments or returned checks.

Common Misunderstandings

Several misconceptions circulate regarding the $2,000 deposit:

- Not everyone will receive exactly $2,000. Some may get more, some less, and many may not receive any payment at all.

- No action is required. Accurate filing is crucial. Missing forms, incorrect information, or unfiled returns can prevent payments.

- It is a stimulus check. In reality, it is part of the normal tax refund and credit process.

Checking Your IRS Payment Status

The safest way to track expected payments is through official IRS tools. These allow taxpayers to check refund status and processing updates directly. Avoid relying on social media posts, emails, or third-party websites, which may spread false information or scams.

The IRS does not send unsolicited messages about guaranteed deposits. Requests for personal or banking information from unofficial sources should be treated as suspicious.

Steps Taxpayers Should Take

To avoid delays and ensure eligibility:

- Review tax filings carefully for accuracy

- Respond promptly to any IRS notices

- Verify bank account and mailing information

- Consult a qualified tax professional if unsure about refundable credits or return details

Staying informed through official IRS updates is the most reliable way to manage expectations during the January deposit cycle.

Final Takeaway

The IRS $2,000 January 2026 deposit is best understood as a potential refund or credit-related payment, not a universal stimulus. Amounts, eligibility, and timing vary based on individual tax circumstances.

Being proactive, filing taxes correctly, and relying on official information ensures a smooth process and helps taxpayers plan effectively for early 2026.

Disclaimer: This article is for informational purposes only and does not constitute financial, tax, or legal advice. No universal IRS $2,000 stimulus payment for January 2026 has been officially announced. Payment amounts, eligibility, and timelines depend on individual tax situations and may change. Readers should consult the official IRS website or a qualified tax professional for guidance specific to their circumstances.