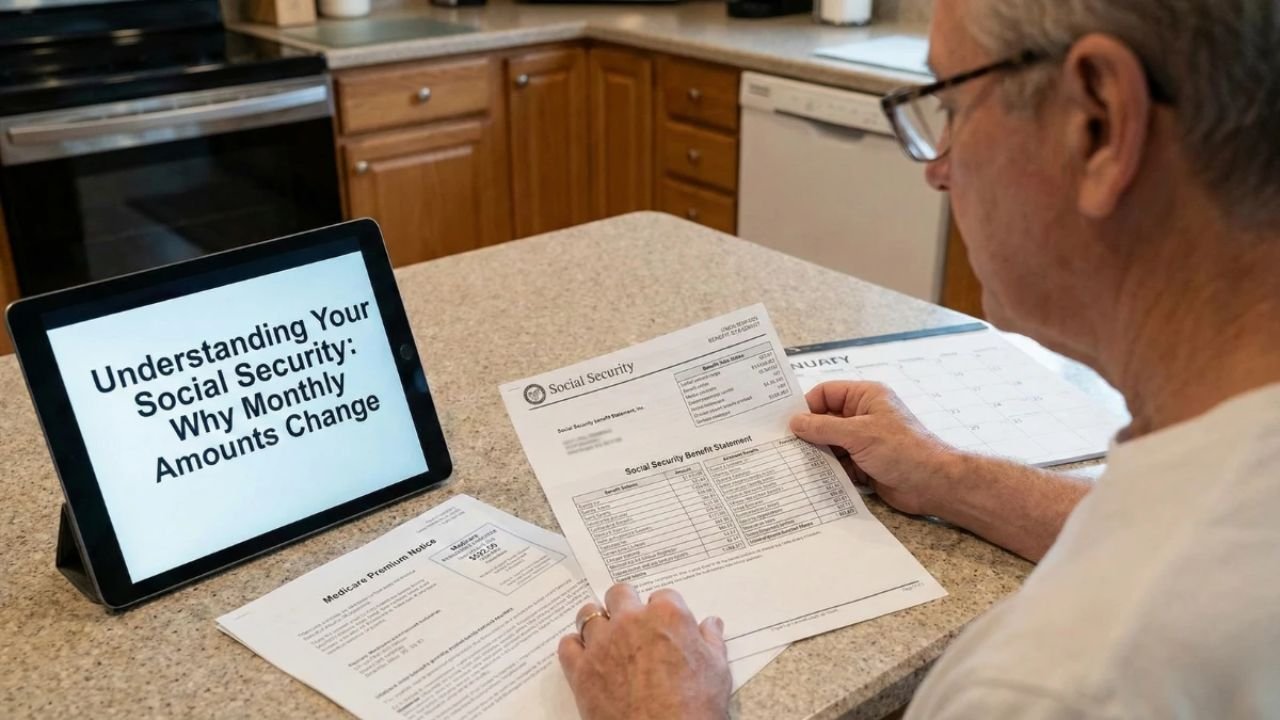

For millions of Americans, Social Security payments are a critical source of monthly income. Naturally, beneficiaries may feel concerned when a deposit arrives earlier or later than expected. While it can cause temporary worry, in most cases, these shifts are completely normal and follow long-standing rules established by the Social Security Administration (SSA). Understanding why payment dates can vary helps recipients plan their finances with confidence.

Why Social Security Payment Dates Sometimes Change

Social Security does not distribute payments randomly. Each benefit type—whether retirement, disability, or survivor—follows a fixed schedule tied to the beneficiary’s birth date or program rules. However, the calendar itself can create situations where payments appear earlier or later than usual. These shifts are typically procedural, not indicative of an error or policy change.

Weekends and Federal Holidays

One of the most common reasons for a payment date change is the occurrence of weekends or federal holidays. If a scheduled payment date falls on a Saturday, Sunday, or recognized federal holiday, the SSA issues the payment on the previous business day. This early deposit can make it seem like the schedule has shifted, even though the system is simply following its standard protocol.

Different Rules for SSI and Retirement Benefits

Not all Social Security payments follow the same calendar.

- Supplemental Security Income (SSI) is generally paid on the first day of each month.

- Retirement, survivor, and disability benefits are typically paid on Wednesdays, based on the beneficiary’s birth date.

When a recipient transitions between benefit types—for example, moving from SSI to retirement benefits—the payment date may temporarily appear different. This adjustment is normal and does not indicate a problem with the account.

The Role of Banks in Payment Timing

Even after the SSA releases funds, banks influence when money appears in accounts. Some financial institutions post deposits early in the morning, while others may process them later in the day or the next business day. These variations can create the impression of inconsistent payment timing, though the SSA’s schedule remains unchanged.

New Beneficiaries and Recent Adjustments

Individuals who recently started receiving Social Security or have had a benefit adjustment may notice a one-time timing difference. This is usually a result of system updates while records are being finalized. After the initial adjustment, future payments return to the standard schedule without issue.

When to Worry—and When Not To

A shifted payment date does not mean benefits are reduced or stopped. There is no penalty for the adjustment, and no new rules are being applied. The SSA recommends:

- Check the official SSA payment calendar for your benefit type.

- Wait at least one full business day after the adjusted date before reporting a missing payment.

In most cases, the payment will arrive as scheduled once these factors are considered.

Final Understanding

Social Security payment date shifts are a normal part of the system. They are typically caused by:

- Weekends or federal holidays

- Differences in benefit types (SSI versus retirement/disability)

- Bank processing schedules

- Record updates for new beneficiaries

By understanding how the payment calendar works, recipients can avoid unnecessary stress and manage their finances confidently. Staying informed about SSA rules and timelines ensures that beneficiaries can track their benefits accurately and plan accordingly.

Disclaimer:

This article is for informational purposes only and does not constitute financial or legal advice. Social Security payment schedules are governed by federal law and official SSA procedures. For personal guidance, beneficiaries should consult the Social Security Administration directly.