For millions of Americans, a tax refund is more than a seasonal perk—it’s an essential part of budgeting for bills, savings, and everyday expenses. As the 2026 tax season approaches, understanding the IRS tax refund schedule can help taxpayers set realistic expectations and avoid unnecessary stress.

How the IRS Refund Process Works

The IRS begins processing a federal tax return only after it has been officially received and accepted. Refund timing depends on several key factors: the method of filing, the completeness and accuracy of the return, and whether additional review is needed.

Electronic filing is the fastest option, and pairing it with direct deposit typically results in the quickest refunds. Paper returns take longer due to manual handling, and any errors or missing documents can further extend processing times. Each year, the IRS adjusts internal timelines based on workload, staffing, and fraud prevention measures.

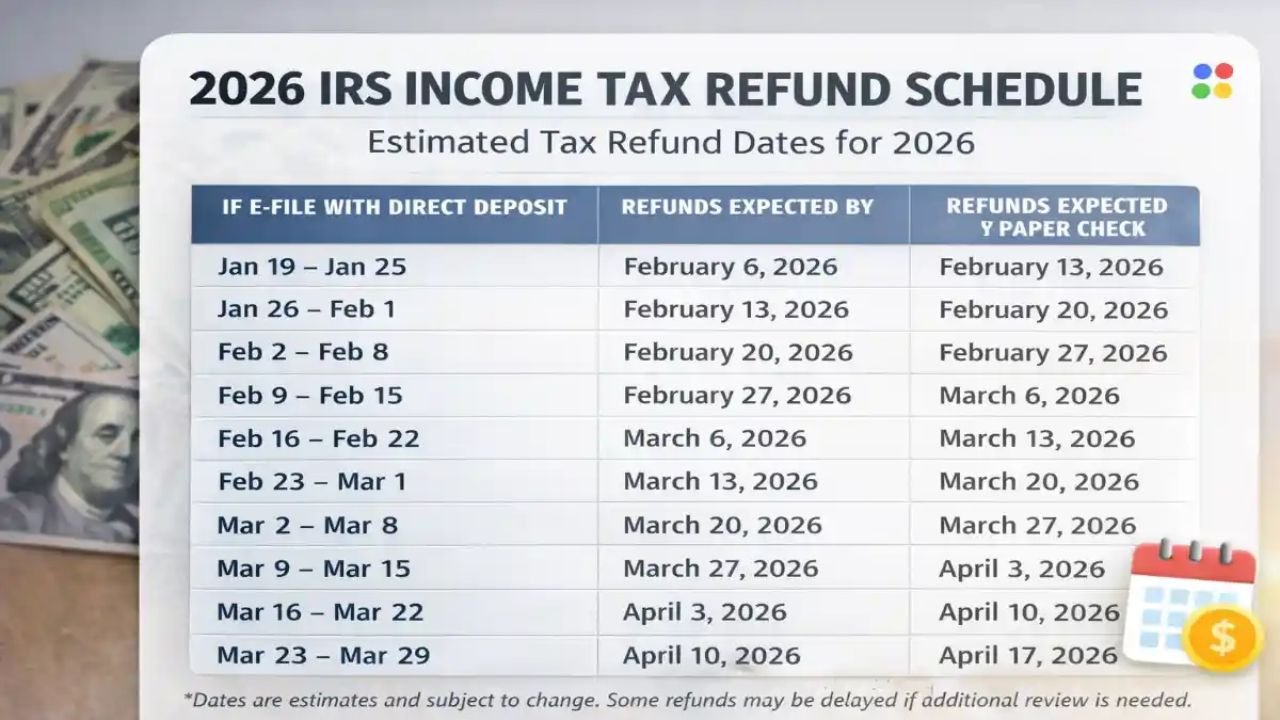

Expected IRS Tax Refund Timeline for 2026

While the IRS does not provide guaranteed refund dates, historical trends offer a helpful guide:

- Late January 2026: The IRS is expected to begin accepting 2025 tax year returns.

- Early filers with direct deposit: Refunds often arrive within two to three weeks of acceptance, meaning mid-February to early March for many taxpayers.

- Paper returns: Refunds generally take four to six weeks or longer, depending on postal delivery and manual processing.

- Late filers: Those submitting returns closer to the April deadline may see refunds in late April or early May.

Reasons Why Tax Refunds May Be Delayed

Even carefully prepared returns can face delays due to:

- Errors in filing: Incorrect Social Security numbers, mismatched income information, or missing forms.

- Claiming certain credits: Refundable credits, such as the Earned Income Tax Credit (EITC) or Additional Child Tax Credit, require extra verification.

- Identity verification: If the IRS needs to confirm identity, processing times increase.

- Banking errors: Incorrect account numbers or closed accounts can delay direct deposits.

It is important not to file a second return unless you are certain a mistake occurred, as this can further slow the process.

How to Check Your Refund Status

The IRS provides official tools for tracking refund progress. These include the “Where’s My Refund?” tool and the IRS2Go mobile app. These platforms update once per day, showing whether your return has been received, approved, or sent.

Remember, frequent checking will not speed up processing. A lack of updates is not always a sign of a problem, as many returns continue moving through the system behind the scenes.

Tips to Receive Your Refund Faster

To minimize delays and receive your refund promptly:

- File electronically instead of by paper.

- Opt for direct deposit rather than a paper check.

- Double-check all information and include all required forms.

- File early to avoid seasonal backlogs later in the filing season.

Final Thoughts on the 2026 Tax Refund Schedule

Although exact refund dates vary by taxpayer, most individuals can expect IRS tax refunds between late January and April 2026. Understanding the process, preparing accurate returns, and using official IRS tracking tools can make the experience smoother and less stressful.

By staying informed and proactive, taxpayers can better manage expectations and reduce the anxiety that often accompanies refund season.

Disclaimer:

This article is for informational purposes only and does not provide tax, legal, or financial advice. IRS rules, refund timelines, and procedures may change. Individual circumstances vary, and taxpayers should consult official IRS resources or a qualified tax professional for guidance specific to their situation.