As the 2026 income tax filing season approaches, millions of Americans are closely monitoring IRS refund timelines. For many households, tax refunds are not just an extra—they are critical for covering rent, medical bills, credit card debt, or everyday expenses. With ongoing economic pressures and rising living costs, knowing when refunds will arrive is more important than ever.

When the 2026 Tax Filing Season Begins

The IRS has confirmed that it will begin accepting federal income tax returns on January 26, 2026. The April 15 filing deadline remains unchanged. While the calendar may feel familiar, this year brings updates that could affect processing speed. New tax rules enacted in 2025 require system adjustments, which may impact how quickly returns are reviewed, particularly early in the season.

Why Refund Timing May Be Slower in 2026

The IRS has updated software, verification systems, and reporting tools to reflect recent tax law changes. These adjustments can slow processing at the start of the filing season. Even minor discrepancies between reported income and employer records can trigger delays. Additionally, ongoing staffing shortages mean some returns may require longer manual review, adding to wait times.

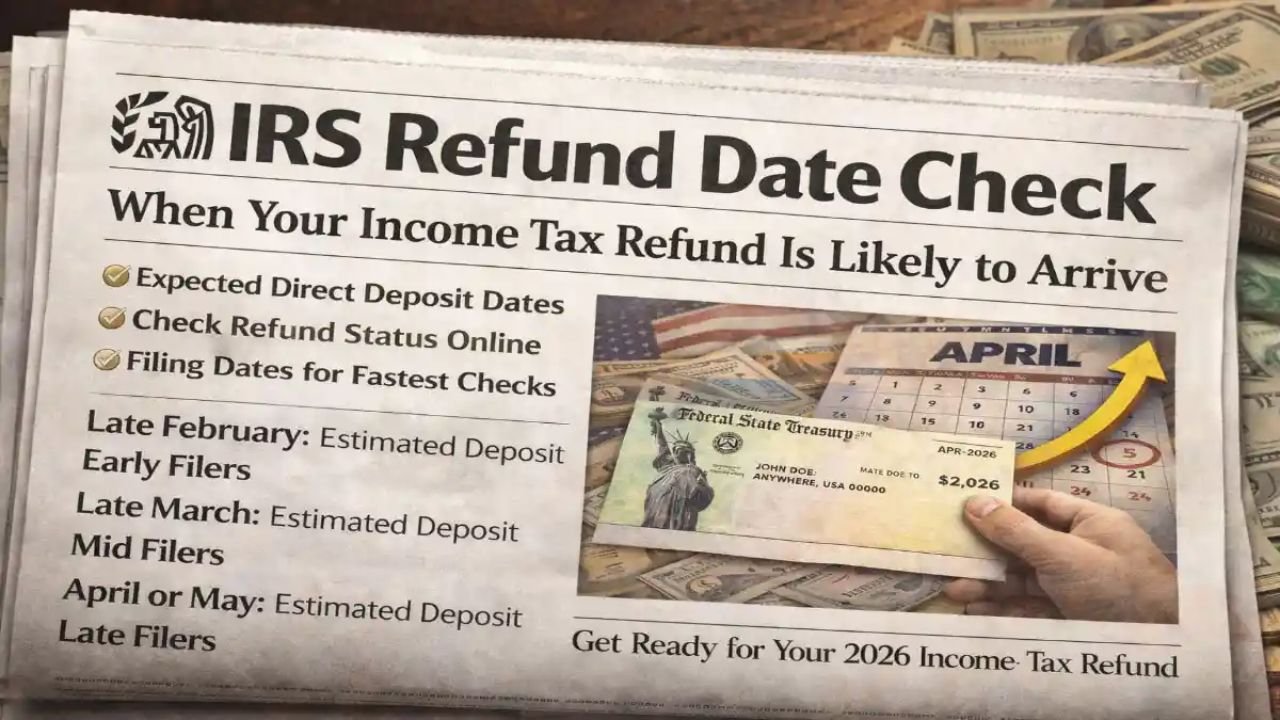

Expected Refund Timeframes

For electronically filed returns with direct deposit, refunds are generally processed within 10 to 21 days under normal circumstances. Taxpayers who file shortly after January 26 with simple, error-free returns may receive refunds by mid-February. However, early-season adjustments and verification procedures may push some refunds later, even for timely filers.

Refund Delays for Certain Tax Credits

Some refunds are legally delayed regardless of filing date. Returns claiming the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC) require additional verification. These refunds are typically not released until mid-February or later, with many arriving in March. These delays can be particularly challenging for lower-income families who depend heavily on timely refunds.

Shift to Fully Electronic Refunds

A notable change in 2026 is the elimination of paper refund checks. All IRS refunds will now be issued via direct deposit or approved electronic methods. While this improves efficiency and security, it may create challenges for unbanked or underbanked taxpayers. Alternative electronic services, such as prepaid cards, can involve additional fees, which should be considered when planning finances.

How to Avoid Unnecessary Delays

Accuracy is more important than speed. Errors in income reporting, personal details, or bank information can trigger additional IRS reviews, slowing refunds. To minimize delays, taxpayers should:

- File returns electronically

- Double-check all personal and financial information

- Use direct deposit for faster, secure payments

Staying proactive and careful during the filing process is the most reliable way to receive refunds on time.

What Taxpayers Should Expect

While the 2026 refund schedule follows a familiar structure, processing times will vary. Some taxpayers may receive refunds quickly, while others may experience delays due to system checks, verification of tax credits, or updated filing procedures. Planning conservatively and monitoring official IRS updates can help reduce stress and ensure financial stability during tax season.

Key Takeaways

- IRS tax returns will be accepted starting January 26, 2026, with the April 15 filing deadline unchanged.

- Refunds for simple, electronically filed returns with direct deposit may arrive in 10–21 days, but delays are possible.

- Returns claiming EITC or CTC may face additional verification and arrive later, often in March.

- Paper checks are eliminated; all refunds will be issued electronically.

- Accuracy and up-to-date information are essential to avoid unnecessary delays.

Bottom Line

The 2026 IRS refund season brings familiar deadlines but also new system updates that may affect timing. Understanding the schedule, filing accurately, and using direct deposit can help taxpayers receive their refunds efficiently. By staying informed through official IRS channels and planning carefully, households can navigate the filing season with confidence and avoid unnecessary stress.

Disclaimer: This article is for informational purposes only and does not constitute tax, legal, or financial advice. IRS rules, refund timelines, and tax laws are subject to change. Individual circumstances vary, and readers should consult IRS.gov or a qualified tax professional for guidance specific to their situation.